DEVASTATING TIPPING POINTS

THROUGH DIFFERENCES

IN EXPONENTIAL GROWTH.

by

C. le Pair

clepair@casema.nl

Abstract

Exponential growth or compound interest may easily generate astronomic numbers. Which lead to impossibilities in a limited domain. This paper shows, how also differences in exponential growth can lead to unexpected socially disastrous situations. A plausible example of such a growth of wealth, lasting centuries and bringing prosperity to mankind as a whole is modelled. It shows how a gently proceeding generally appreciated process brings on a catastrophe as a result of a mathematically unavoidable tipping point phenomenon.

Sad to say that the presented model seems to fit society's current course.

Introduction

An old anecdote tells about the chess inventor charming an Indian Radjah with his new game. The enchanted Radjah wanted to reward him generously. "Tell me what you want and you'll get it." The inventor grinned and asked just one grain of rice on the first of the 64 squares of his chess board and subsequently every time double the previous amount on the next square. The Radjah soon learnt that there would not be enough rice in the whole world to keep his promise.

Bankers and loan sharks in the Middle Ages knew already that a compound interest rate of only a few percent would generate tremendous wealth (or debt) over a long period of time. A rate of 2% p.a. would in 35 years double a capital or a debt. In a formula a capital of 10 dollar against a compound interest of 2% in x year would grow to an amount A dollar as

In the seventies of last century The Club of Rome, a group of influential rich people, contracted some scientists, to report about what this simple formula and the Radjah's lesson would mean for mankind in a world endowed with limited resources.

The result appeared as a report(1) "The Limits to Growth". It was widely discussed and its warning became general public knowledge. It is in fact nothing more than a substantiation of the ancient wisdom: "what is lost and not suppleted" becomes less".

Soon after its appearance critics showed that the timing in the report did not comply with events in the real world, but its overall message apart from the timing is irreputable. New techniques and new discoveries falsifying the conclusions of the report did only postpone most of the doomsday messages. And showed: there is enough time to change some of our behaviors, to make the warnings irrelevant.

I shall not elaborate on those behavioural changes here. But to me it is obvious that we should reduce the use of some finite natural resources and aim for a gradual reduction of the human population. But I emphasise that we have time enough to do it slowly and in a humane way. There is no emergency. The rules of the game should be: honest, good science based advice and education; not enforcement.

The theme of the present paper I presented earlier in a web page in Dutch, which should rather be named a draft note(2). Therin the 'tipping point' consequence of differences between exponential growth rates was shown. I used a primitive model using intuitive parameters of growth rates of wealth in an arbitrary fixed set of people. Because this note and its result caused some noise and comments among a small group of colleagues, whom I sent it to, and I was myself surprised about the agreement with some phenomena currently publicly discussed, I looked for some confirmation or rejection about my parameter assumptions. These I found in the study of Thomas Piketty c.s. published in his book 'Capital in the 21st century(3)'.

According to the New York Times it is probably the most important book of the year in 2014. Together with an accompanying website it contains a wealth of worldwide economic and demographic data over centuries. The data presented are the work of a multitude of authors and investigators in many countries and over numerous years. I consider it a treasure trove for anyone interested in the distribution of wealth in the widest sense. The book requires rather advanced knowledge of economic terms and processes to be fully understood. Such is way above my capacities. In the next section I shall explain in what way I made use of it.

The model in a growing population

My model consists of a set of 100.000 people(4) and their wealth at the start in the year 1700. I had in mind the city of Amsterdam and some nearby towns, home to the Board members of the VOC (the United East Inda Company) in an era generally considered as the beginning of financial capitalism.

Any other number of people and their wealth at the start would change head counts and wealth proportionally, but not the timing of events. Timing depends on growth rates and the initial number ratios to one another. The set is followed over about three centuries. (In the previous scratch note(2) I used a fixed set.) I learned from Piketty that the demographic development may not be neglected. It also affects the timing of events and the distribution of wealth.

Demographic evolution varies over time and regions. The same is true for the accompanying capitals, In some regions and certain periods the population diminished or grew at a tremendous rate of 4% p.a..

In the new model the growth trend of the population is 1% p.a.. This resembles the average proxy estimates of the whole world from around the year 1000. (Piketty, with some hesitation mentions 0,8% - 1%) .

Also the wealth evolution and its distribution varies between periods and regions. The model's common wealth grows 2% p.a..

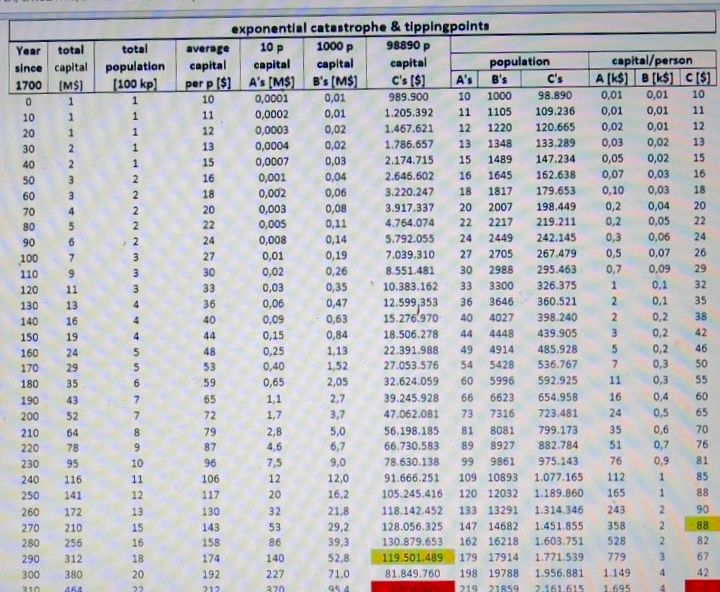

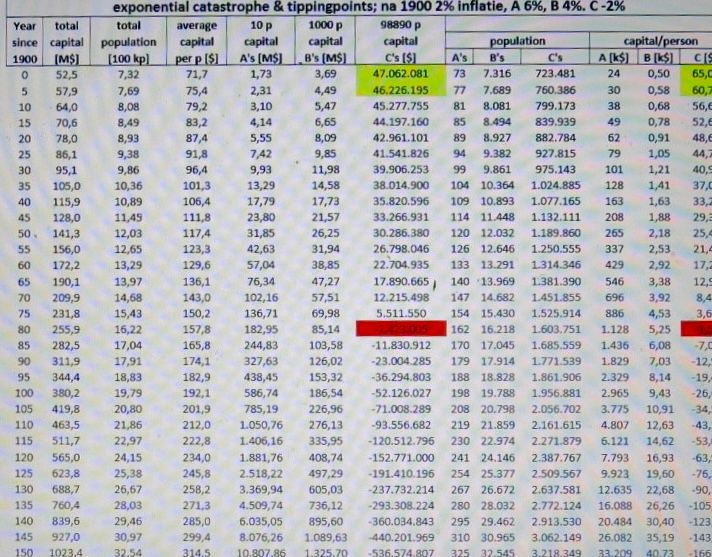

The population is subdivided in three groups, A, B and C. At the start the A-group consists of 10 p, the B-group of 1000 p and the C-group of 98.990 p.

In the start year all people own the same wealth, 10 $ each. (In Amsterdam in 1700 this equality was certainly not the reality. In a later paragraph I shall say something about the $ as yardstick. )

The whole population works for its daily needs and to create reserves (more security in the future). The A-group values security more than the others. They know that wealth attracts wealth and they reinvest. Therefore their wealth grows 5% p.a..

The B-group knows the same, but saves a little less. So its wealth grows 3% p.a.. When security is no longer an issue, these growth ranges remain the same. Due to the fact that wealth offers power over others. This brings an advance, when negotiating trade agreements.

The C-group does not care enough about its future security to use their earnings for saving. It is content with its share in the growing common wealth; i.e. the total capital less the A- and B-parts..

As is shown in the evolvement of the said parameters in Table 1, this state of affairs is beneficial to the population as a whole. The average wealth of all members of the set is growing during centuries.

Table 1.